OUR TOP PRIORITY IS SECURITY

Your security and trust are important to us.

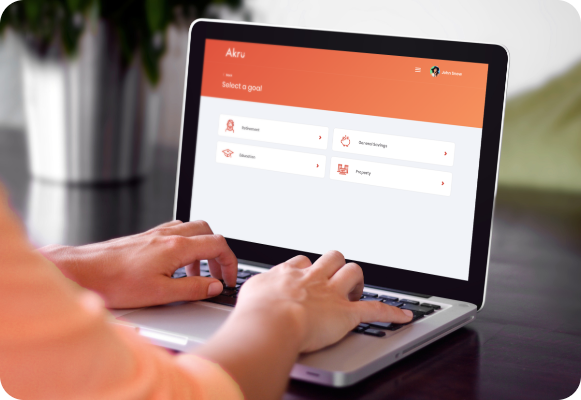

Akru adopts current industry-best practices and technology to secure our application and safeguard your investments.

Two-factor authentication for transactions

Protection of your assets by third-party custodians

Regulated by Securities Commission Malaysia

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)